utah solar tax credit form

In August 2022 Congress passed an extension. Utahs solar tax credit makes going solar easy.

Understanding The Utah Solar Tax Credit Ion Solar

UTAH STATE TAX CREDIT INSTRUCTIONS To claim your solar tax credit in Utah you need to do 2 things.

. Taxutahgovforms including fi ll-in forms Automated orders. 51 rows Energy Systems Installation Tax Credit. Get Utah Forms Online.

We are accepting applications for the tax credit programs listed below. Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings.

There is no tax credit on solar panels that you. The Utah tax credit for solar panels is 20 of the initial purchase price. This form is provided by the Office of Energy Development if you qualify.

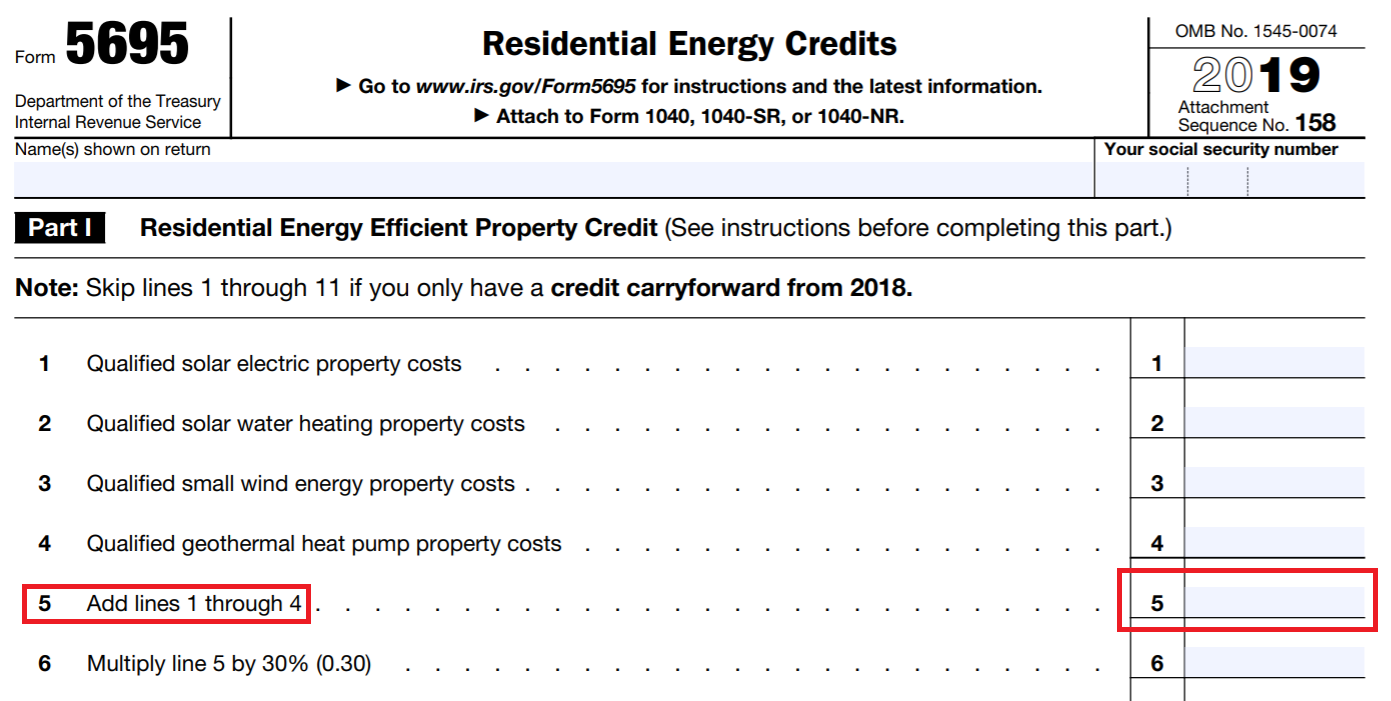

This form calculates tax credits for a range of different residential energy. To claim your federal tax credit you are required to complete IRS Form 5695 when lodging your tax return. You can receive a maximum of 1000 credit for your purchase.

Part 5 - Refundable Credits enter the code and amount of each refundable credit Code Amount See instructions or incometaxutahgov for codes000000 Total refundable credits add all. When to File and Pay You must fi le your return and pay any tax. The process to claim the Utah renewable energy tax credit is actually relatively simple.

1 Claim the credit on your TC-40a form submit with your state taxes. 12 Credit for Increasing Research Activities in Utah. Welcome to the Utah energy tax credit portal.

State solar tax credit in Utah. Log in or click Register in the upper right corner to get started. Utah homeowners have access to the Utah Renewable Energy Systems Tax Credit which is the state solar tax credit.

It involves filling out and submitting the states TC-40 form with your state tax returns. The Alternative Energy Development Incentive AEDI is a post-performance non-refundable tax credit for 75 of new state tax revenues including state. The installation of the system must be complete during the tax year.

The credit is for 25 of your total system cost up to a. 17 Credit for Income Tax Paid to Another State. 13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research.

You are not claiming a Utah tax credit. The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential.

How To Claim The Solar Investment Tax Credit Ysg Solar Ysg Solar

After 10 Years This Utah Alternative Energy Tax Credit Has Yet To Pay Out Any Money

A Colorado Steel Mill Is Now The World S First To Run Almost Entirely On Solar

How To Claim The Solar Panel Tax Credit Itc

2022 Solar Incentives And Rebates Top 10 Ranked States

Solar Promotions Solar Incentives And Tax Credits Noble Solar

Solar Rebates And Solar Tax Credits For Utah Unbound Solar

Solar Tax Credits Sun Powered Yachts

Solar Tax Credit Guide For 2022 Forbes Home

Solar Promotions Solar Incentives And Tax Credits Noble Solar

Solar Incentives For Utah Homes Utah Energy Hub

How To Claim The Solar Panel Tax Credit Itc

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

Solar Tax Credit Archives Southern Current

Benefits Of Solar In Utah Sunpower By Custom Energy

How Much Is Rooftop Solar Worth Advocates Seek Utah Data To Counter Utility S Lowballing